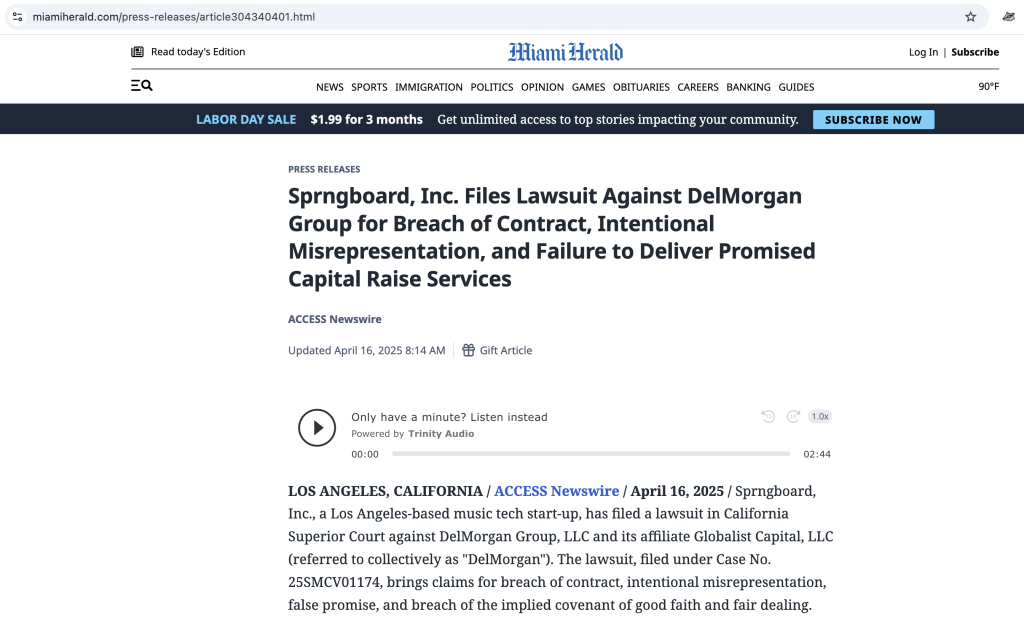

Click here to read an article written about DelMorgan & Co. (Reflects author’s views. Shared for informational purposes.)

Read the full complaint for Sprngboard, Inc. v. DelMorgan Group, LLC here

Below is news coverage on DelMorgan & Co. from multiple news outlets:

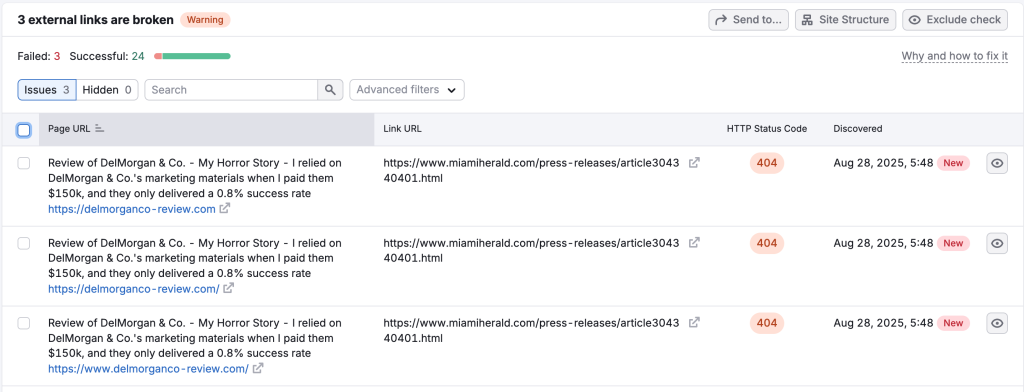

Miami Herald (See article below, as the link appears to have been deliberately “broken” by a suspicious group or individual. This incident seems to be part of an ongoing series of targeted attacks against the site.)

Below is a list of DelMorgan & Co.’s prior lawsuits I found after engaging the company, which I wish I had been aware of beforehand; it would have warned me of the company’s pattern of highly litigious behavior. Instead, I blindly trusted the vague positive reviews and press, only to be utterly disappointed by the complete lack of results I experienced.

Why are there suddenly so many positive reviews on Google following Curtis Allen’s insightful 1-star review (see below) posted in January? Before that, there were only two 5-star reviews—one with no explanation and the other simply stating, “wow.” To me, this feels like an attempt to bury the true results DelMorgan delivers to its clients.

I’ve spoke to parties (the defendants) involved in multiple lawsuits below and they shared an extremely similar experience – paid DelMorgan & Co. a six-figure fee (sometimes $150,000, like we paid them) after DelMorgan stated they would assist with securing funding to help their company grow. However, something even worse happened in their situations: Not only did DelMorgan not secure any investors or financing, they sued the client because the client secured its own funding without DelMorgan’s assistance.

Litigation and suing innocent clients after receiving large sums of money from them should not be a company’s business model.

If I had known what I do now before working with CEO Neil Morganbesser and Managing Director Richard Johnson, I would have avoided this company like the plague. The entire experience with DelMorgan & Co. has been an absolute horror story!

DELMORGAN GROUP, LLC, A CALIFORNIA LIMITED LIABILITY COMPANY, ET AL. VS PHOENIX CAPITAL GROUP HOLDINGS, LLC, A DELAWARE LIMITED LIABILITY COMPANY, ET AL.[FILING DATE 01.10.25; CASE NUMBER: 25SMCV00146; FILED IN SANTA MONICA COURTHOUSE]

DELMORGAN GROUP, LLC, A CALIFORNIA LIMITED LIABILITY COMPANY, ET AL. VS THC DESIGN, LLC, A CALIFORNIA LIMITED LIABILITY COMPANY, ET AL. [FILING DATE 07.11.23; CASE NUMBER: 23STCV16140; FILED IN STANLEY MOSK COURTHOUSE]

DELMORGAN GROUP, LLC, A CALIFORNIA LIMITED LIABILITY COMPANY, ET AL. VS FARMACEUTICALRX LLC, AN OHIO LIMITED LIABILITY COMPANY [FILING DATE 04.19.22; CASE NUMBER: 22STCV13069; FILED IN STANLEY MOSK COURTHOUSE]

DELMORGAN GROUP, LLC, A CALIFORNIA LIMITED LIABILITY COMPANY, ET AL. VS AUSTRALIS CAPITAL, INC., A NEVADA CORPORATION [FILING DATE 03.22.22; CASE NUMBER: 22STCV10008; FILED IN STANLEY MOSK COURTHOUSE]

DELMORGAN GROUP, LLC, A CALIFORNIA LIMITED LIABILITY COMPANY, ET AL. VS ENSYSCE BIOSCIENCES, INC. [FILING DATE 07.12.21; CASE NUMBER 21STCV25585; FILED IN STANLEY MOSK COURTHOUSE]

DELMORGAN GROUP, LLC, A CALIFORNIA LIMITED LIABILITY COMPANY, ET AL. VS FIORE MANAGEMENT, LLC [FILING DATE 12.18.19; CASE NUMBER 19STCV45872]

DAVID WALDER VS DELMORGAN GROUP LLC ET AL [FILING DATE 02.10.17; CASE NUMBER BC650357; FILED IN STANLEY MOSK COURTHOUSE]

DELMORGAN GROUP LLC VS LE JOLIE LLC [FILING DATE 12.04.15; CASE NUMBER SC125073; FILED IN STANLEY MOSK COURTHOUSE]

Miami Herald

Proof of suspicious attacks to pertinent links on this website.

Below is a business owner’s summary of her conversation with Rob Delgado, co-founder of DelMorgan.

Sharing the Google review of someone with a similar experience. Again, there appears to be a pattern of behavior. How can DelMorgan & Co. be allowed to continue to operate?

This is my story

My name is Emma. For as long as I can remember, I have been a music fan; it is part of my family’s fabric. So much so that when I was eighteen, I started my own music label. I signed a few artists, wrote and negotiated contracts, managed the bands and got them shows! That experience led me to a major label, which then brought me to a world class concert venue, and then to the premiere global live entertainment company. Collectively, this gave me fifteen years of music marketing experience.

Throughout that time, I earned a Bachelor’s degree, a Masters in Business Administration, and I am now working towards a law degree in entertainment law. I have always been ambitious and have strived to achieve my goals. Everything has come with hard work and long hours, sometimes requiring working two to three jobs while attending classes. However, I never shied away from the required efforts because the harder I had to work, the more gratifying the accomplishment. This ambition led to spending two and a half years building a female-owned entertainment company, while in law school. This company was to be built on the principles of advocacy and diversity. Everyone would have a place, a voice, and a community to share their passion. The only thing it lacked was funding.

I sought funding with great expectations, with an open mind and excitement of making my vision come true. That came to a complete halt when I was introduced to a company called DelMorgan & Co. What I did not know is that only two percent of female companies have the opportunity to be funded and that only eight percent actually get funded. I was in mere desperation, but was told that DelMorgen would solve all my problems. It wasn’t long before I realized that I was wrong!

After a couple of weeks of conversations with DelMorgan, I was led to believe that funding was guaranteed and would only take three months. Because of this guarantee, I agreed to pay their enormous engagement fee of $150,000.00. This fee is not only almost double my annual salary, it required me to take out copious loans. Alongside the loans that I will be paying off for the next eight years, I accepted money from my elderly father who prior to giving me the much-needed funds said, “let’s go and achieve your dreams.” He, too, believed in my vision.

My motivation to start the music label at eighteen was to advocate for artists rights and to protect them from unfavorable agreements. Ironically, I am in the exact situation I sought to save artists from. I am bound by a severely one-sided agreement that has allowed DelMorgan to walk away with $150,000.00 without providing any sort of services that deserve that sort of excessive payment. I worked my entire life to avoid being in debt, I even earned scholarships to help pay for school. Yet, I am now left with crushing and debilitating debt because of believing in a company that took advantage of my confidence in their abilities and my desperation for an investment firm to see beyond my gender.

I write this knowing that others may not have experienced the exact situation, but may have experienced something similar. Maybe we share similar experiences by trying to grow a small business with big dreams, or when sitting in a room filled with men that don’t see us for who we truly are and what we have to offer, or have been taken advantage of because of the extreme disparity in available business opportunities.

Now my goal is to turn lemons into lemonade. I hope that this experience can be a platform for change. Specifically, change that will close the gender gap in funding distribution to female-founded companies.

Please join me in demanding change by signing this petition today!

Have you had a similar experience with DelMorgan & Co.?

Contact us with your story at info@delmorganco-review.com

or sign our petition here.